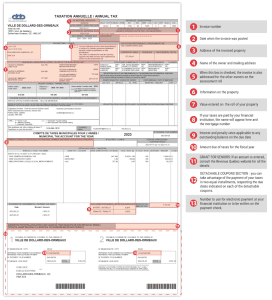

Property tax bill

Your property tax bill was sent on January 23, 2024, and is payable in two installments: February 22, 2024, and May 23, 2024. Please note that no reminder will be sent for the second payment.

If you have not received your tax bill yet, please request a copy by email at taxationDDO@ddo.qc.ca or by phone at 514-684-1010.

Methods of payment

In accordance with An act respecting municipal taxation, if your bill is greater than $300, you can choose to pay it in full on the first payment due date, or in two equal payments on the two due dates determined by Council for the current year.

For this year the due dates are:

- 1st payment – February 22, 2024

- 2nd payment – May 23, 2024

If your bill is less than $300, it must be paid in full on the first due date of February 22, 2024.

Payments received after this date will be subject to 9 % interest rates and 5 % penalty rates per year.

Water rates (non-residential buildings)

Since September 1, 2023, all non-residential buildings must be equipped with water meters to ensure accurate measurement of the building’s water consumption. Buildings in part or in full intended for non-residential use pay a rate based on their water consumption recorded on the meter.

This initiative aims to encourage the adoption of environmentally friendly behaviors and aligns with the Quebec government’s strategy for water conservation.

The city has established a flat rate of $0.85 per cubic meter of water consumed. If part of the building is for residential use, a volume of 225 cubic meters per dwelling is deducted from the total annual consumption.

Invoices for the period from September 1, 2023, to August 31, 2024, will be sent in autumn 2024 and must be settled within 45 days from the date of issue.

How to make a payment

You can pay your tax bill online through your bank account, as long as the service is provided by your financial institution. Make sure to enter your 12 digit reference number, starting with 11. Do not enter a space after 11. This number appears after the mention “RÉFÉRENCE POUR PAIEMENT ÉLECTRONIQUE / REFERENCE FOR ELECTRONIC PAYMENT” on your payment stub. In order to avoid interest and late penalty fees, schedule your transaction in advance, and allow two business days for payment processing.

You can pay your bill at most financial institutions. Some may refuse to accept your payment so check with your bank first. If you pay through a banking machine allow at least 48 hours, excluding Saturdays, Sundays and holidays, for the payment to be processed thus avoiding interest and penalty charges.

Please include your cheque or money order made out to City of Dollard-des-Ormeaux with the payment stub from the bottom of your bill. Please allow sufficient time for delivery to ensure that your payment is received by the due date and to avoid interest and penalty charges being added to your account.

City of Dollard-des-Ormeaux

Taxation Department

12001, boulevard De Salaberry

Dollard-des-Ormeaux (Qc) H9B 2A7

We suggest that you include in the same mailing the second payment coupon with a post-dated check

You can pay at the City Hall service counter, Monday to Friday, between 8 a.m. and 4 p.m. We accept cheques, debit cards and cash. Credit cards are not accepted.

You can also drop off your payment in the mail slot located at the entrance of City Hall.

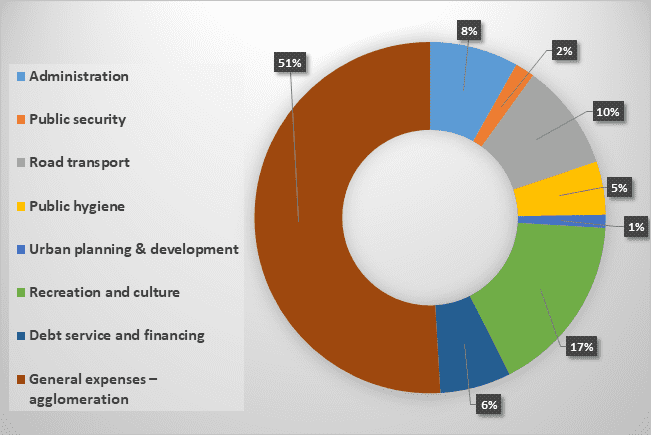

Tax rates

Categories – Property taxes per $100 evaluation | 2023 | 2024 |

|---|---|---|

General tax | 0.822 | 0.7572 |

6 dwellings or more | 0.852 | 0.8401 |

Non-residential immovables | 3.612 | 3.5572 |

Industrial immovables | 3.612 | 3.6972 |

Vacant lands – served (twice the general rate) | 1.644 | 1.5144 |

Vacant lands – not served (general rate) | 0.822 | 0.7572 |

Water tax per unit | 2023 | 2024 |

|---|---|---|

Single family dwellings | $290,00 | $315,00 |

Apartments and condos | $200,00 | $215,00 |

Duplex, triplex and quadruplex | $200,00 | $215,00 |

Retirement homes | $90,00 | $95,00 |

Public pools | $780,00 | $850,00 |

Apartment pools | $390,00 | $425,00 |

Useful references

This information sheet contains information of no legal value; the official regulation of the Law prevails.

For more information, dial : 514 684-1010