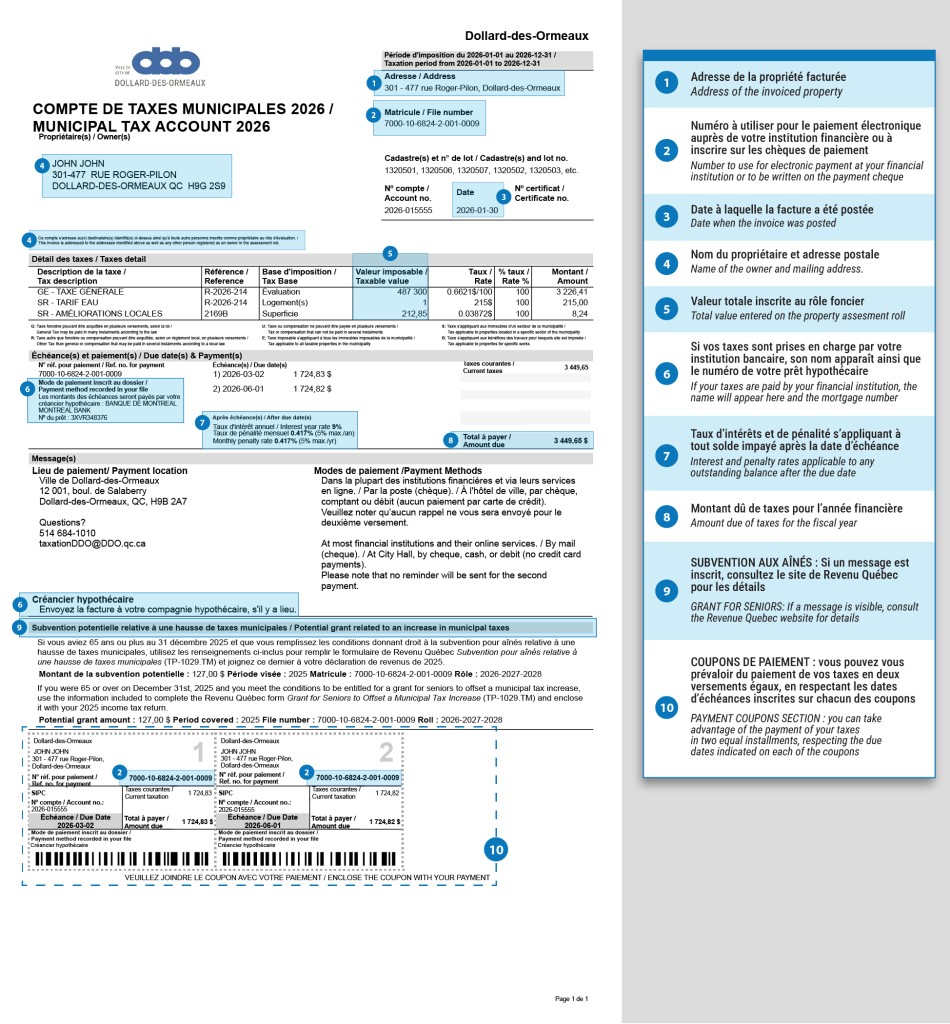

Property tax bill

You should expect to receive your property tax bill at the beginning of February, and it is payable in two installments; on March 2 and June 1, 2026. No reminder will be sent out for the second payment.

Terms of payment

In accordance with An act respecting municipal taxation, if your bill is greater than $300, you may pay it in two equal payments on the two due dates determined by Council for the current year. If your bill is less than $300, it must be paid in full on the first due date.

Payments received after the due dates will be subject to 9% interest rates and 5% penalty rates per year.

Access your tax bill online

The City now uses the Voilà! app, which provides residents with quick and easy access to their online tax bill, as well as their notice of assessment.

To access it for the first time, follow these steps:

- Click the button below.

- Create your user account on the portal.

- Add your property using your address or the account number found on your paper bill.

- Link your property to your tax account using the account number and the amount of the first payment listed on your paper bill.

Once registered, you will only need to enter your username and password to access your online account.

How to make a payment

If your financial institution allows it, you can pay your tax bill by entering the 18-digit reference number for payment (file number) without hyphens, as it appears on your invoice.

In order to avoid interest and late penalty fees, schedule your transaction in advance, and allow two business days for payment processing.

You can pay your bill at most financial institutions. Some may refuse to accept your payment so check with your bank first. If you pay through a banking machine allow at least 48 hours, excluding Saturdays, Sundays and holidays, for the payment to be processed thus avoiding interest and penalty charges.

Please include your cheque or money order made out to City of Dollard-des-Ormeaux with the payment stub from the bottom of your bill. Please allow sufficient time for delivery to ensure that your payment is received by the due date and to avoid interest and penalty charges being added to your account.

City of Dollard-des-Ormeaux

Taxation Department

12001, boulevard De Salaberry

Dollard-des-Ormeaux (Qc) H9B 2A7

We suggest that you include in the same mailing the second payment coupon with a post-dated check

You can pay at the City Hall service counter, Monday to Friday, between 8 a.m. and 4 p.m. We accept cheques, debit cards and cash. Credit cards are not accepted.

You can also drop off your payment in the mail slot located at the entrance of City Hall.

Water rates (non-residential buildings)

Since September 1, 2023, all non-residential buildings must be equipped with water meters to ensure accurate measurement of the building’s water consumption. Buildings in part or in full intended for non-residential use pay a rate based on their water consumption recorded on the meter.

This initiative aims to encourage the adoption of environmentally friendly behaviors and aligns with the Quebec government’s strategy for water conservation.

The city has established a flat rate of $0.85 per cubic meter of water consumed. If part of the building is for residential use, a volume of 225 cubic meters per dwelling is deducted from the total annual consumption.

Invoices for the period from September 1, 2024, to August 31, 2025, will be sent in autumn 2025 and must be settled within 45 days from the date of issue.

Tax rates

Categories – Property taxes per $100 evaluation | 2025 | 2026 |

|---|---|---|

General tax | 0.6948 | 0.6621 |

6 dwellings or more | 0.8013 | 0.7853 |

Non-residential immovables | 3.3898 | 3.1521 |

Industrial immovables | 3.4437 | 2.8159 |

Vacant lands – served (4 times the general rate) | 2.7792 | 2.6484 |

Vacant lands – not served (general rate) | 0.6948 | 0.6621 |

Water tax per unit | 2025 | 2026 |

|---|---|---|

Single family dwellings | $315,00 | $315,00 |

Apartments and condos | $215,00 | $215,00 |

Duplex, triplex and quadruplex | $215,00 | $215,00 |

Retirement homes | $95,00 | $95,00 |

Public pools | $850,00 | $850,00 |

Apartment pools | $425,00 | $425,00 |

Useful references

This information sheet contains information of no legal value; the official regulation of the Law prevails.

Property assessment

For questions regarding the notice of assessment, please contact the City of Montreal’s Property Assessment Department:

- 514-280-3825

- evalinfo@montreal.ca

- Consult the property assessment role